Some ads can become immediately memorable, and for me, this is one of them:

PharmEasy, one of India’s largest healthcare platforms, began its journey in 2015 when founders Dharmil Sheth and Dhaval Shah envisioned an easier way for people to access healthcare. They wanted to simplify the healthcare experience by offering a one-stop solution for all needs – medicines, diagnostics, teleconsultations, and wellness products.

What started as an online pharmacy quickly expanded, transforming into a complete healthcare platform that caters to millions of Indians. This start-up is currently valued at $458 million. Let’s see how they’re doing their marketing.

Market Entry and Challenges

PharmEasy entered a highly competitive and fragmented Indian healthcare market.

Their challenge was twofold:

building consumer trust in online healthcare services

tackling the logistical complexities of delivering medicines across India’s diverse regions.

Their breakthrough came through strategic investments and partnerships. In June 2020, PharmEasy merged with Ascent Health, the biggest offline pharma retailer in India, to form API Holdings. This move brought in additional co-founders – Siddharth Shah, Hardik Dedhia, and Harsh Parekh – who helped scale the business.

Their most significant milestone was acquiring Medlife in May 2021, further consolidating their position as a leader in the e-pharmacy space. PharmEasy’s rapid rise to prominence is backed by significant funding and strategic deals.

In 2021, it became India’s first e-pharmacy unicorn, raising $1.77 billion in 13 rounds. The acquisition of 66.1% stake in Thyrocare, one of India’s largest diagnostic companies, for ₹4,546 crore ($600 million) was another game-changer, propelling PharmEasy into the diagnostics space and significantly expanding its offerings.

This deal gave them a massive network of collection centers and strengthened their position as a comprehensive healthcare provider. With over 25 million customers, 6,000 digital consultation clinics, and a vast retail network, PharmEasy has truly redefined the way healthcare is accessed in India.

STP & SWOT Analysis

Segmentation:

- Behavioral Segmentation:

PharmEasy appeals to people who prefer the convenience of online shopping, especially those who need regular medications.

- Geographic Segmentation:

The company focuses mainly on tier-1 and tier-2 cities where digital literacy and access to the internet are more prevalent.

- Demographic Segmentation:

It appeals majorly to middle-aged adults who are likely juggling work and family and millennials.

Targeting:

Their primary audience includes urban middle-class families, tech-savvy professionals who are used to digital solutions, and elderly customers who need convenient access to medications. They use a differentiated strategy to address the unique needs of both urban and semi-urban areas.

Positioning:

The brand positions itself as affordable, accessible, and convenient healthcare at the customer’s doorstep. This is motivated by their mission to provide a reliable, one-stop healthcare solution, ensuring customers perceive them as a trusted and convenient option.

Strengths:

The backbone of any successful e-pharmacy is its strong supply chain. They’ve nailed this, allowing them to offer an extensive range of products and services, from medications to diagnostics.

Strategic partnerships and acquisitions further bolster their credibility. Also, over time, they’ve built a loyal user base, which acts as a solid foundation for growth.

Weaknesses:

Logistics in healthcare are incredibly complex, and reliance on this network can sometimes backfire, especially during disruptions like the COVID-19 pandemic. Plus, competition is fierce, with both established companies and startups vying for the same customers. Regulations can be a minefield of changing rules as well.

Opportunities:

In a post-COVID world, telemedicine and online healthcare services are booming, opening a massive door for expansion. There’s also a growing healthcare awareness, even in rural areas, which offers a largely untapped market, though PharmEasy has already been venturing in these areas.

Introducing wellness and fitness products could further diversify their offerings and capture a health-conscious audience.

Threats:

Regulations around online pharmacies is tricky and subject to sudden changes. Offline pharmacies have begun to adapt, creating hyperlocal delivery networks to offer medicines faster than some e-pharmacies. Price wars with key competitors like Netmeds and 1mg can erode profit margins

Competitor Analysis

1mg:

One of PharmEasy’s toughest competitors, Tata 1mg has carved out a niche for itself by not just being an online pharmacy but also doubling down on content marketing and healthcare education.

They’re known for providing medically verified articles, detailed drug information, and tie-ups with hospitals and diagnostic centers. This educational content builds trust, attracting users who want more than just medicine delivery.

Moreover, 1mg has established itself as a one-stop solution for healthcare, offering lab tests and consultations as well .

Netmeds:

Now backed by Reliance, Netmeds benefits from one of India’s largest retail and logistics networks. Being under Reliance has given them a substantial edge in scaling their operations, making medicine deliveries faster and more efficient, giving them a huge boost in customer trust and reach.

Apollo Pharmacy:

What sets Apollo Pharmacy apart is its strong offline presence. As one of India’s largest pharmacy chains, Apollo had the trust and brand equity long before it ventured online.

Their integrated omnichannel approach, with hospitals, pharmacies, and online services under one brand, makes Apollo a trusted name in healthcare.

Plus, their widespread presence means they already have an established customer base across both urban and rural areas. Let’s look at PharmEasy’s marketing mix to understand how it markets itself to stand out.

Marketing Mix

Product:

PharmEasy’s product offering isn’t just limited to medicines; they have created a full-fledged healthcare platform. They offer:

- Medicines:

Prescription and over-the-counter drugs, covering a vast range of categories.

- Diagnostics:

They’ve made lab tests accessible by offering at-home sample collection and online test results.

- Wellness Products:

This includes a variety of health supplements, personal care items, and fitness-related products.

- Telemedicine:

With the rise of telehealth, PharmEasy also allows users to consult doctors online for various health conditions.

- Value-added services:

PharmEasy provides additional services like subscriptions for regular medicines (perfect for chronic patients), timely refills, and health-related content like blogs and tips through their app and website.

Price:

PharmEasy’s pricing strategy is largely competitive, as the e-pharmacy space in India is driven by affordability. Their pricing structure includes:

- Discounts and Offers:

They regularly roll out promotional deals for first-time users, seasonal offers, and festive discounts which attract new customers.

- Profitability:

Through subscription models and repeat customers, users keep coming back for regular health checks and purchases.

- Diagnostic Pricing:

In the diagnostics segment, they provide competitive rates for lab tests compared to traditional labs. Plus, the convenience of at-home testing makes the pricing feel more valuable to customers.

They also offer a membership program, PharmEasy Plus, where customers can get 5% extra credits and free delivery.

Place:

PharmEasy’s distribution is entirely through an online platform, making their app and website the primary points of contact for customers.

- Nationwide Delivery:They have built a logistics network that spans across urban and rural areas, allowing them to cover a large part of India.

Their strong backend ensures timely deliveries, and they’ve invested heavily in ensuring medicine availability in all regions.

- Logistics Strategy:

To streamline delivery, PharmEasy partners with local pharmacies and diagnostic centers, creating a decentralized fulfillment system.

This allows them to offer faster delivery times, particularly in tier-1 and tier-2 cities.

Rural penetration is also expanding as they focus on reaching previously underserved areas.

Promotion:

PharmEasy has a digital-first promotional strategy. It is known for its creative and engaging promotional strategies, which have helped the brand build significant awareness and loyalty.

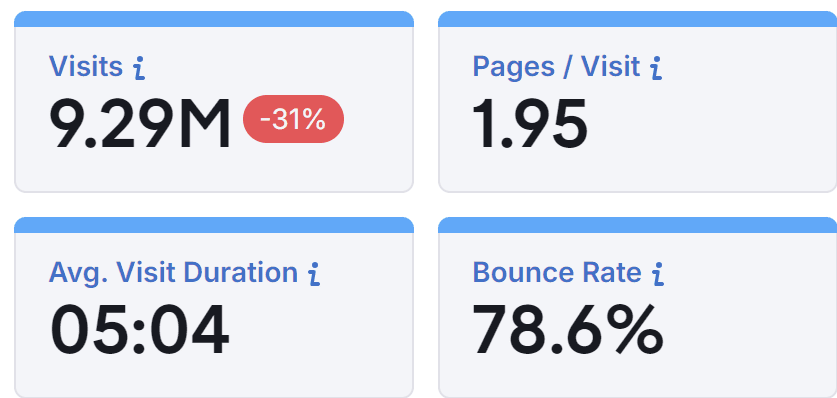

In August 2024, here’s what their SEO looked like:

Though the average visit duration is decent, the number of visits were down by 31% than the previous month, which could be because of seasonal changes or changes in promotional strategies.

Pages per visit is less than 2, meaning that most visitors don’t explore much beyond the first couple of pages, possibly because they find what they need quickly. Another similar metric is the 78.6% bounce rate. This means that nearly 8 out of 10 visitors leave after viewing just one page. This can indicate that the content may not meet their expectations or isn’t as engaging as hoped.

Their content marketing has a unique approach with PharmEasy Web Stories. This makes informational content bite-sized rather than lengthy blogs and anyone can get the crux of a topic in minutes.

They’re also active across social media channels. On Instagram, pharmeasyapp has 91.1K followers. A major pillar of it’s strategy is entertaining rather than being purely informative. For instance, reels like this:

Also, relatable and timely posts like this:

This approach keeps it fresh for the GenZ and millennials, who are more likely to engage. It helps to take the seriousness out of the health world and majorly keep a llight-hearted approach.

This also extends to their ad campaigns. For instance, in the “Take It Easy PharmEasy” campaign, they used relatable and humorous scenarios to convey how easy it is to order medicines through the PharmEasy platform.

Another campaign was “Aapki Health Aapke Haath Mein Hai” (Your health is in your hands).

The unexpected twist of the neighbor falling out of the ceiling keeps it memorable. During COVID-19, they also introduced this simple yet thoughtful awareness campaign:

The company also roped in Amir Khan as a brand ambassador:

They created a series of quirky ads with the actor which helped to increase credibility and awareness about the brand. These strategies have helped the company to get 1Cr+ downloads for the app and millions of customers across India!

In a Nutshell

PharmEasy’s journey from an online pharmacy to a healthcare powerhouse is a testament to the strength of its tech infrastructure, customer-first approach, and strategic acquisitions. Its success shows the importance of staying agile, particularly in a highly competitive market.

Key Takeaways from PharmEasy’s Marketing

Strategic partnerships and acquisitions can drastically enhance business growth and market penetration.

Leveraging tech infrastructure and logistics is essential for scaling in complex markets like healthcare.

Adopting a customer-first approach, including personalized offers and services, fosters long-term loyalty.

Creative content marketing, especially through engaging digital and social media strategies, builds brand trust and engagement.

Diversifying product offerings can help businesses stand out in a crowded market.